Kunji Finance Partners with MUX Protocol as its DEX Partner

Kunji Finance has integrated with the MUX protocol providing asset managers access to the derivative markets on the Arbitrum chain.

We are thrilled to announce an exciting partnership between Kunji Finance and MUX Protocol. Kunji Finance is a decentralized platform built on Arbitrum that connects asset managers with liquidity providers, allowing those asset managers to leverage their skills with access to further capital while generating trading-based profit opportunities for capital providers. The platform has integrated with the MUX protocol providing asset managers access to the derivative markets on the Arbitrum chain. Trading on derivative markets allows asset managers to manage risk against adverse market movements with long and short positions and generate higher returns.

Why derivative markets?

Currently, DeFi users have only access to protocols with long-only strategies, where they can earn up to 10% yield. Kunji Finance is building the first decentralized platform that offers actively-managed strategies with both long and short positions, allowing users to earn better yields. For this, the protocol is integrated with spot and derivative decentralized exchanges. MUX integration will help Kunji asset managers to trade on derivative markets. Derivatives trading will open up multiple opportunities to investors with Kunji Finance investment strategies that include hedge against risk, higher yield, and access to new markets.

Here are the key takeaways of the partnership with the two key products of MUX Protocol:

MUX Leveraged Trading Protocol: A decentralized leveraged trading protocol that offers zero price impact trading, no counterparty risks for Kunji traders, and an optimized on-chain trading experience. Traders will trade against the MUX native pool (MUXLP pool) on the Leveraged Trading Protocol.

MUX Leveraged Trading Aggregator: A sub-protocol in the MUX protocol suite that automatically selects the most suitable liquidity route and minimizes the composite cost for Kunji traders while meeting the needs of opening positions. This will not only optimize the trading cost but also enhance the user’s ROI.

Ethereum’s Layer 2 scaling solution Arbitrum has low transaction fees and ideal throughput. This makes it appealing for decentralized financial applications like perpetual trading platforms.

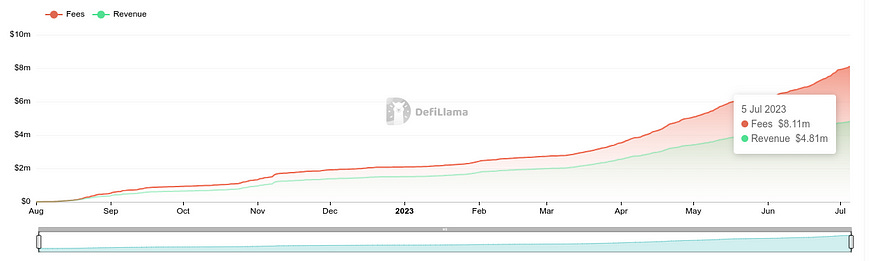

Recently, Arbitrum activity was boosted by MUX protocol, with dramatic growth in the protocol’s fee. Due to network volume, the dApp reached an all-time high. 90% of this protocol’s fees, $5.2 million, went to the Arbitrum ecosystem.

With Kunji Finance’s partnership with MUX protocol, Kunji asset managers will be able to trade on-chain with optimized trading costs and generate higher returns for strategies with leverage trading opportunities and enhanced risk management.

Commenting on the collaboration, Anurag Dixit, founder of Kunji Finance, said, “Our vision is to create a viable crypto hedge fund alternative for every crypto user where they can invest any amount in a strategy that meets their risk appetite. Till now, asset management has not really taken off in the crypto world because discretionary strategies deployed were long only and didn’t perform well when the market was bearish. Our endeavor is to remove this constraint, and MUX, being a prominent decentralized derivatives exchange, is going to be a key partner in making this vision a reality.”

About MUX Protocol:

MUX Protocol is a decentralized perpetual exchange built on five chains, i.e., Arbitrum, BSC, Optimism, Avalanche, and Fantom. It offers zero price impact trading, up to 100x leverage, no counterparty risks for traders, and an optimized on-chain trading experience. Learn more: https://mux.network/

About Kunji Finance:

Kunji Finance is a decentralized platform built on Arbitrum that enables crypto hedge fund-like active portfolio management services for retailed investors while providing full custody control and transparency. The asset management services can be based on discretionary investment theses that run long and short strategies created by asset managers on the platform, enabling the creation of “hedge funds” for retail investors without any regulatory ambiguity. Kunji is to crypto hedge funds what Uber is to Limo services. Learn more: https://www.kunji.finance/